Table of Contents

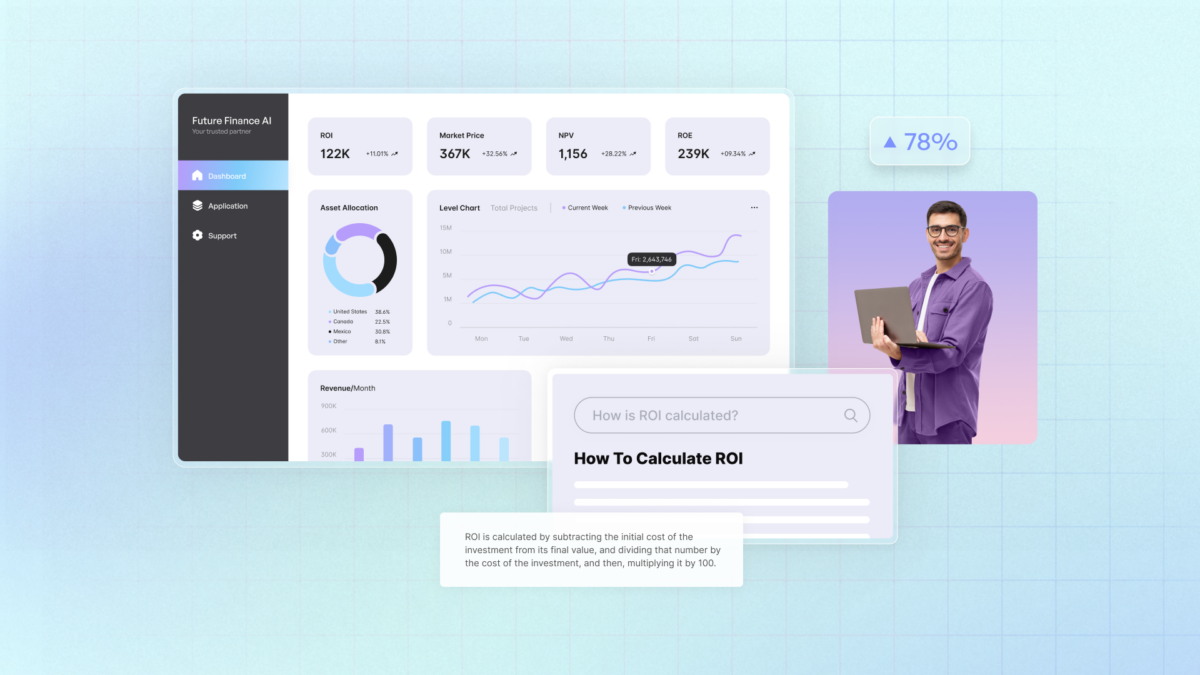

How Generative AI Can Transform the Finance Industry

Artificial intelligence is already deeply embedded in the finance industry. 85% of financial services companies already use AI in some form, with plans to integrate AI even further within the next two years. When it comes to Generative AI, however, companies are just beginning to scratch the surface.

The finance industry faces unique challenges in implementing Generative AI, in large part due to the stringent regulatory landscape designed to protect customer data, ensure fair practices, and maintain market integrity. Despite these and other challenges, forward-thinking financial companies recognize the immense potential of Generative AI and are actively seeking ways to harness its transformative power.

In this article, we will delve into use cases in which Generative AI has the highest potential to revolutionize the finance industry by streamlining operations, enhancing customer experiences, and assisting in making data-driven decisions.

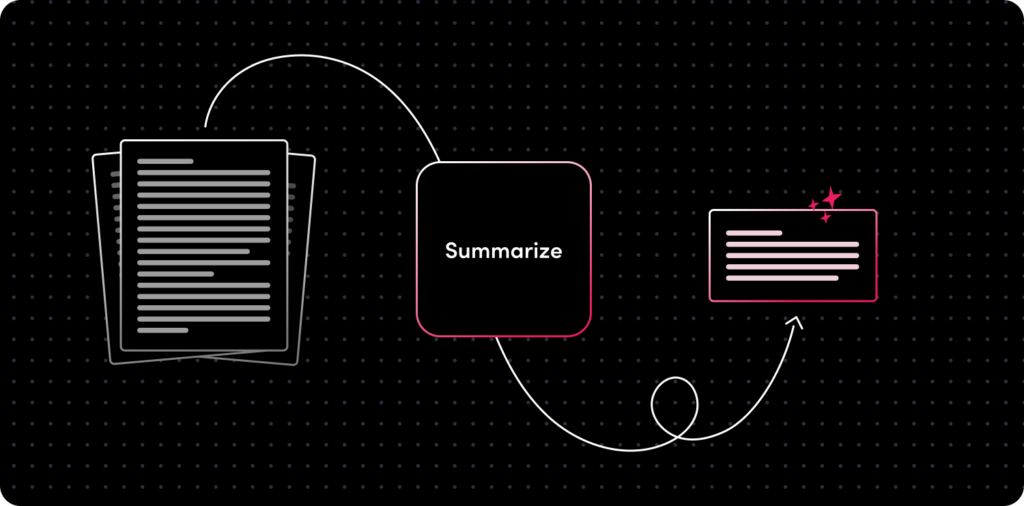

Summarizing financial documents and unstructured data

Finance professionals working in investment banking, research departments, and asset management sales teams face the challenging and time-consuming task of reviewing and analyzing complex documents. This requires not only reading and digesting large amounts of information, but also understanding and drawing actionable conclusions from it.

A specialized summarization language model like Summarize API extracts key points from one or multiple documents, while remaining true to their original source. By incorporating this model into a solution, firms can condense large amounts of information accurately and efficiently, reducing the need for financial analysts, researchers and sales teams to manually read and analyze unstructured data. It not only saves time, but also reduces human error, where the eye can misread content or miss key points when faced with an overwhelming amount of information.

Bloomberg has already started using a summarization solution to help both financial professionals and clients address the overwhelming amount of financial news, saving them a vast amount of time and allowing them to stay updated with the latest developments.

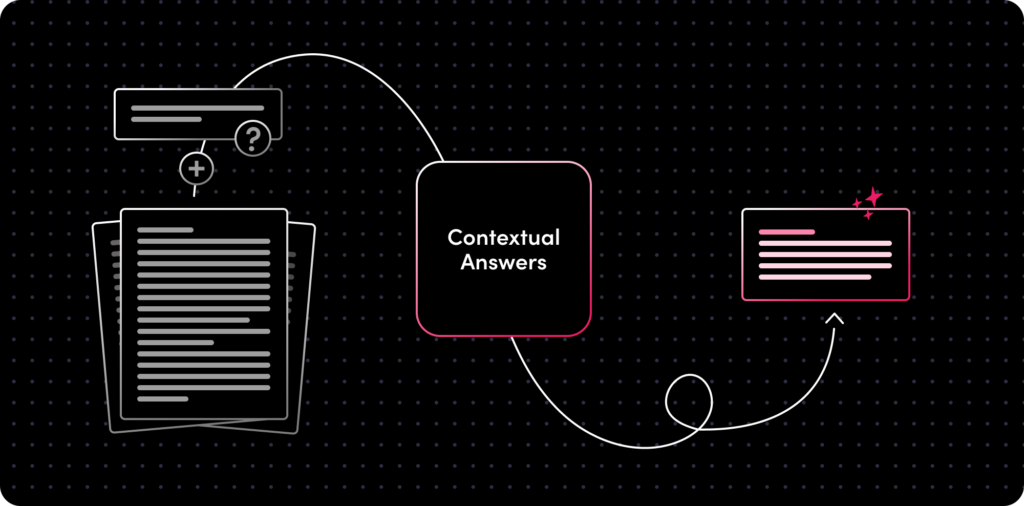

Extracting the right information

Financial analysts, asset managers, and research departments within investment and retail banks are required to extract specific information from a large corpus of financial data to promptly address customer inquiries. Consequently, they find themselves diligently sifting through vast amounts of information across multiple documents, in search of the exact answers or solutions.

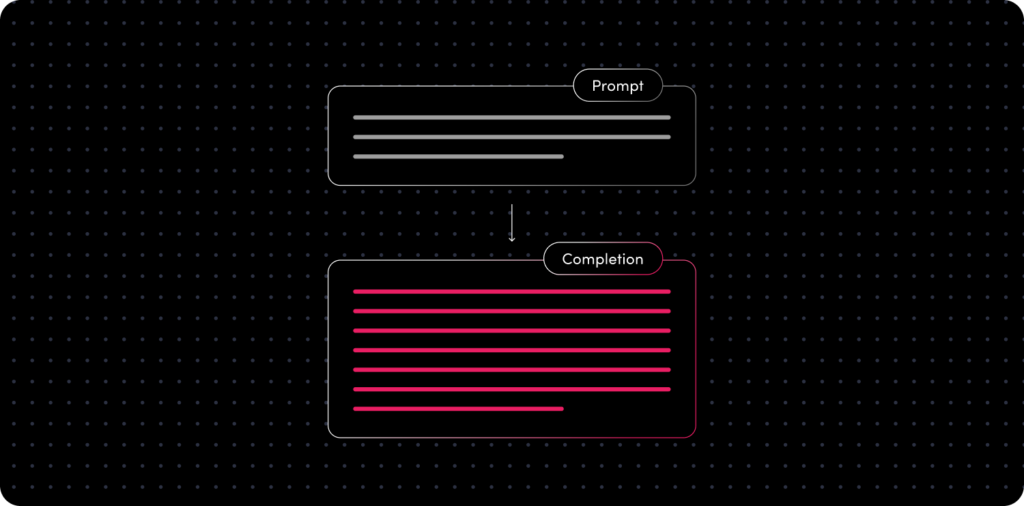

Here, a multi-doc Contextual Answers solution can make a huge difference. Contextual Answers uses a combination of NLP and machine learning to analyze the context of documents and provide rapid, accurate answers to specific queries.

For example, if you want to find out if a particular action will contravene a rule included in a set of regulations, you can type in your question directly and the model will retrieve the answer from within the text, giving your answer higher levels of accuracy, and avoiding hallucinations.

One firm using a similar solution is Morgan Stanley. Over the years, Morgan Stanley conducted extensive research on companies, sectors, and markets, which they compiled into a large library. They recently announced a Generative AI-powered question answering solution to enable brokers to ask the library questions and receive answers in an easily digestible format.

Customer Support

Today’s customers expect immediate and helpful responses to their inquiries. Financial companies struggle to meet these demands, as they are time-consuming and resource-intensive.

Generative AI emerges as a valuable tool in addressing these challenges by incorporating chatbots capable of addressing customer inquiries effectively. Generative AI-driven chatbots, designed to respond with information solely based on the content contained in a company’s database, ensure the delivery of reliable and rapid responses. Through the strategic deployment of Generative AI, financial institutions can strike a balance between operational efficiency and customer satisfaction.

Capital One has already started to experiment with using Generative AI in order to automate and improve their customer service, using AI chatbots that better understand customer queries and concerns.

Extracting relevant data from transcripts and other documents

Another important but time-consuming task that financial institutions face is extracting relevant information and conducting intent analysis from call transcripts. For example, if a customer calls a bank to make a financial trade, the bank is required, for compliance and regulatory reasons, to document the details of this call in their records in a specific format.

Here too, Generative AI serves as an effective tool by applying named entity recognition, which can extract specific words from unstructured data and categorize them. Continuing from the previous example, Gen AI can be used to extract details from a customer call, including the quantity, price, time stamp and confirmation of execution. The details would then be formatted to conform to the bank’s internal compliance system.

Applying a similar idea, Goldman Sachs is running a POC to extract and classify data from the millions of legal documents they receive, and reformat them to make it understandable to their systems.

Generation of legal documents for investment banks

Generative AI can also streamline and speed up the creation of proprietary legal documents for investment banks. With the implementation of advanced LLMs, Gen AI can assist in drafting complex legal documents with precision and efficiency, tailored to the specific needs and requirements of each investment bank. AI-powered document generation significantly reduces the legal teams’ workload, allowing them to focus on higher-value tasks and strategic decision-making.

Conclusion

Generative AI is already changing the finance industry and leading companies are already finding innovative ways to use it. JP Morgan, Bloomberg, Morgan Stanley and more are already implementing Gen AI to conduct sophisticated financial research, communicate efficiently with clients, and provide better customer support.

Although Generative AI is still in its infancy, most financial leaders are already recognizing the necessity of examining their current processes and strategizing about where AI could be integrated. Otherwise, they risk falling behind.

Due to the high stakes involved, integrating Gen AI in the finance industry requires careful attention and collaboration with trusted software partners, as well as constant human oversight and monitoring. When implemented with care, Generative AI has the potential to skyrocket productivity, revolutionize financial processes and transform the entire industry landscape.